There are so many places you want to travel, but you keep running into the same problem – you can’t afford it.

1. CUT A GUILTY PLEASURE:

Yes, you’ve heard this one before. And eliminating an (unnecessary) expense can be difficult. I get it – iced vanilla lattes are delicious and I’m not saying you can never have one again, but think about it. If you’re spending $5 on coffee 5x per week, you’re looking at $100 per month. That’s a dinner on the beach, or a night of cocktails on the town. Cut it to just 2x per week and you’re saving $60 per month. That adds up!

Are you falling for every online sale you scroll by? Stop. I guarantee the experience of a new city (or going back to one that makes your heart sing) is worth so much more than a pair of jeans that look the same as the three that already exist in your closet. Set a limit on online purchases.

Quit buying lunch every day. In our equation above, that’s $200 a month. Otherwise known as a plane ticket! Make your own salad or sandwich. Give up or at least cut back on pop, eating out, cigarettes, smoothies, beer, shoes, whatever it is for you and you will thank yourself when you’re sippin’ a Mai Tai in paradise.

Need extra motivation? Each time you go to purchase your guilty pleasure, put the money in a jar or your savings account and watch how quickly it adds up! Cut your guilty pleasure for a month. It will change your life .

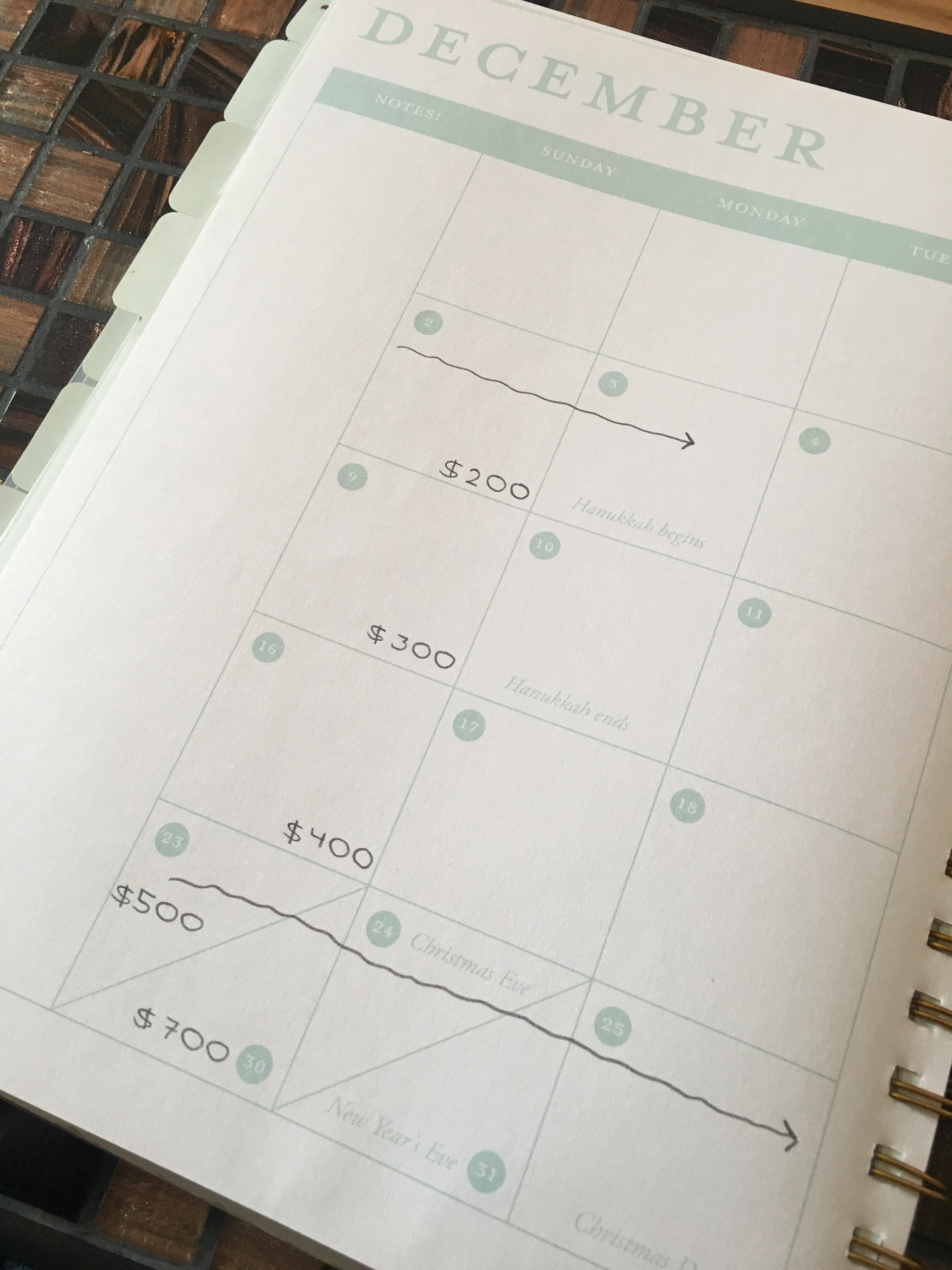

2. TURN LONG TERM GOALS INTO SMALLER CHUNKS – and write them down:

What sounds more attainable? Save $1,000 in the next five months? Or $200 by the end of next month? The latter, of course. Break up your savings into chunks and write down where you want to be by the end of each week or month. There is so much power in writing down your goals. Plus, you are less likely to buy something (see guilty pleasures) if it takes a hit on your short term goals. Keep doing this over time and your long term goals will seem much more attainable.

Bonus: Put pictures of your destination where you can see them – in your wallet, on your bathroom mirror, on the dash of your car, literally wherever you can see them so when you want to spend money, you remember your overall goal – which is hiking up a mountain for surreal views, not an iced latte that is half ice and has your name spelled wrong on the side of the cup. I save for trips before I even know I am going on a trip. Which brings me to our next tip…

3. USE MONEY SAVING APPS:

My favorite app has completely changed the way I manage money. Qapital makes money saving effortless. Qapital will automatically transfer money from your bank account to your app account using different rules (or triggers). And it’s completely free and safe. Knowing I still have the money, but not seeing it in my bank account helps me save thousands.

How much do I save using Qapital in one year?

-

- Set and Forget Rule: $1,300; an automatic weekly transfer. I do $25 every Sunday, year round.

-

- Round Up Rule: $400-500; rounds every purchase made from your debit/credit card up to the nearest dollar and acts as a change jar. I don’t even notice this one!

- Manually: $2,600; sending $100 to my account every paycheck.

If I can save $4,300 per year to travel, so can you! There are plenty of options and one is sure to work for you!

Pro Tip: This app is not limited to vacation budgets. I save for Christmas and hair appointments year round – aka expenses I know are coming.

4. BE MINDFUL OF WHERE YOU SHOP:

Guess what? I don’t step foot in Target. Why? Because you walk in, your eyes get big, dopamine starts flowing and everywhere you look there is something you “need.” Nothing against them, I LOVE Target. But I know my limitations and I know going there drains money faster than you and your friends taking down a late night pizza.

Anywhere you’re surrounded by food, clothes, home decor, books, baby clothes, movies, DVDs, medicine, birthday cards and crafts all in one place, a red flag should go up. Limit the amount of times you visit (1x per month), make a list AND STICK TO IT. Need groceries? Go to a smaller, food-only store where you are not tempted to buy other things. Trader Joe’s is my savior. Want a new dresser? Go to a furniture store. Need Advil? Run into Walgreen’s.

And I know I am about to shock the world here, but I don’t have Amazon Prime. And yes, I understand the convenience of online shopping. And that I pay the occasional shipping charge. Every so often I’ll take to Amazon and have something delivered, but why give myself the power to purchase something at any given moment with the excuse of there’s no shipping? Secret: These companies know what they are doing! Shoes are 30% off and will be at your doorstep tomorrow? Guess what, you’re still spending 70% and you have plenty of shoes. You earn your money. Control where it goes.

5. CONSIDER TIMING:

When you start figuring out the days in which you’ll travel, keep in mind that early morning and late night flights are typically cheaper. Also, keep your lodging in mind. You’re going to save money by taking the first flight out Friday morning and still have the full day vs. leaving Thursday night and having to pay for an extra night (which is basically paying to sleep in a bed that’s not yours). Same goes for departure. Obviously, it’s not always possible to make these arrangements, but always keep in mind how your transportation works with your lodging.

BONUS TIPS:

- Meal Prep Your Week. We all know buying groceries and eating at home is better for your wallet than going out, but take it a step farther. You will not only buy what you need, but utilize all of your ingredients over the course of multiple meals.

- Know Your Expenses. Write down every bill you are currently paying. Is there anything underutilized that you can live without such as cable or your gym membership? Don’t pay for anything that is not serving you on a consistent basis.

- Skip the Theater. A night for two at the big screen with a large popcorn and a couple sodas? $50. A movie at home in the comfort of your own home with a bag of popcorn? $5. Maybe.

How do I know these tips work? Because I use them!

Believe me, I do not roll around in money (more power to you, if you do!) but traveling is a priority for me. And it tends to come up for everyone; your best friend is getting married in Mexico, your nephew is graduating high school in California, the girls are ready for a trip to Nashville or the boys are having a bachelor party in Vegas. Don’t miss these opportunities and experiences because of money. The best part about saving? It’s addicting. And it gets you whatever you want with a little bit of sacrifice and planning. Give one or all of these tips a try and you’re well on your way to your next experience – like drinking a beer on a ferry across the Puget Sound.

Think this sounds awesome but not sure what to do next?

I hear you. Saving money can be overwhelming to start. Send me a message from my Get In Touch Page. I’d love to help get you started! A little guidance from me will have you saving money like a pro and on your way to a new city in no time.

Just downloaded Qapital! Excited to give it a try. Definitely been looking for a new way to save and this seems so simple. Thanks for the recommendation!

Awesome! You will LOVE it. Super easy with tons of saving options. Thanks so much for reading!

Thanks for finally talking about >5 Tips to Save Money For Your Next Trip – Little Blue

Backpack <Loved it! https://918.network/downloads/83-mega888

I completely agree if I don’t see it in my bank account I forget about it. I will have to check out the Qapital app. Great tips!