In this save to travel blog series, I went through how I afford a lifestyle that includes 10-12 trips per year. This is Part 6. It is the wrap up + review + high-level look at all of the 5 previous parts. All parts are linked below. The first two parts of this series are tools I use and the rest are rules I live by to make my lifestyle a reality.

PART 3: Avoid Unnecessary Expenses

OVERVIEW: How I Save $10,000 per year for Travel

PART 6: Overview

TOOL #1: A Simple Budget

I use the 50/30/20 Rule. Based on my monthly income, I budget 50% for my needs, 30% for wants, and 20% goes into my savings. I am able to afford my travel lifestyle while still paying the bills and saving for retirement. It’s all possible—if you have and stick to a budget. If there’s one part I hope you take advantage of, it’s this one. It will give you step-by-step information you need to make a budget that fits exactly to your lifestyle…no matter how much money you make.

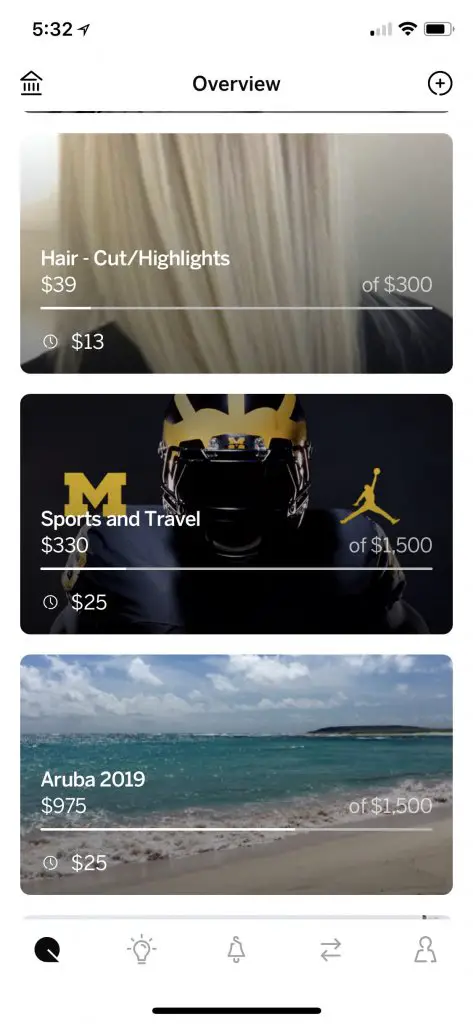

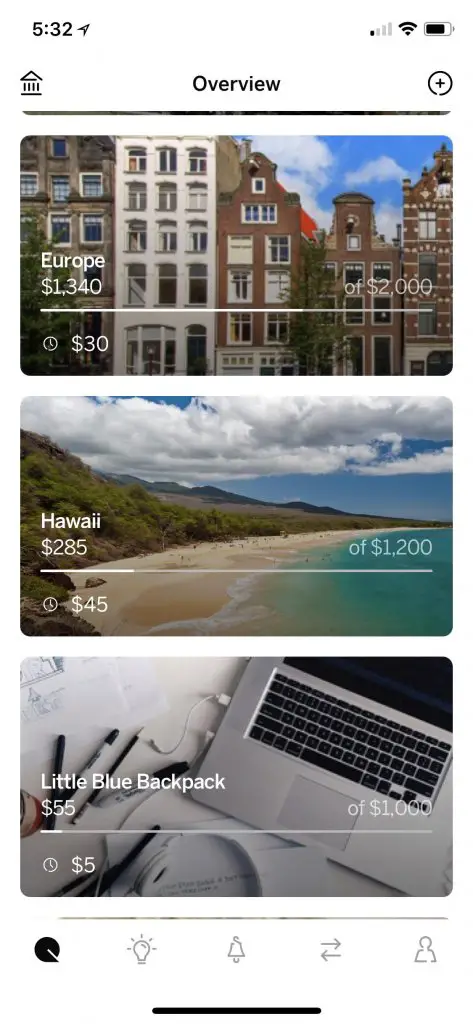

TOOL #2: Qapital

The Qapital app has changed how I manage money and helps me stick to my budget. It automatically transfers money from my checking account to my Qapital account, safely and securely, into different categories I set up for myself. I don’t see the money in my checking account which helps me avoid overspending. And the best part is that I don’t have to lift a finger once it’s set up. Read Part 2 to learn exactly how I use it to work for me.

RULE #1: Avoid Unnecessary Expenses

Are you often shocked at how much money you spent in a week? This part is an eye-opening look at the money I save by planning out my grocery store runs, cooking at home, and being aware of all of my bills and expenses. (It doesn’t take much at all to overspend in these areas.) Read Part 3 for the most tactical tips and takeaways you can start using today to save to travel.

TOTAL AMOUNT SAVED PER YEAR: $4,520

RULE #2: Transportation

I do not overspend when it comes to my car. I drive an embarrassing, ugly, slow, Chevy Malibu with over 200,000 miles on it. Not only is my car payment $0, but my insurance is extremely low for driving around a car with low value.

TOTAL AMOUNT SAVED PER YEAR: $4,200

I don’t make these totals up! You’ll see all of the math with full details.

RULE #3: “Extra Cash”

When things like credit card points, extra paychecks, taxes, and Christmas come my way, my first instinct is not to online shop. It’s to plan ahead and add all of this money directly to my Travel budget. Learn how best to plan ahead for these situations so you can take full advantage.

TOTAL AMOUNT SAVED PER YEAR: $2,800

TOTAL = $11,520

Over $11,520 a year is what I have dedicated to travel every year. And you know exactly how I make that work. Is everyone in the same financial situation? Of course not. But whether you are trying to save for 1 trip a year or 20, you can save the money. The beauty is that all budgets can be perfectly tailored to YOU.

“You can have anything, you just can’t have everything.”

One of my favorite quotes. All 5 parts of this blog series are a choice. Because I choose to spend a significant amount of my income on travel, I also choose to give up certain things that I may enjoy but don’t necessarily prioritize over exploring the world.

WHAT AM I GIVING UP?

Things I REALLY do enjoy, yet don’t prioritize are what make my lifestyle possible. If I purchased these things regularly, I wouldn’t have enough money to travel as often as I do.

- A nice car

- Starbucks Americanos

- Top of the line hair products

- The “Target high”

- An in-home library

- Home decor for every season

- A closet overflowing with clothes

- Chipotle—with guac!

The point is, CHOOSE. Mindlessly spending money is going to get you less of what you actually WANT. Think of your biggest priorities that you know are worth it, maybe two or three (they could be listed above!), and start to determine other areas you can spend less. You make enough money to have whatever you want (in time). But you don’t make enough money to have everything you want.

If you haven’t read Parts 1-5 of this save to travel blog series, I encourage you to start with Part 1 and make your way through. It just might change a few of your spending habits for the better.