Wouldn’t it be awesome to be like Rihanna or Beyonce? Go on vacation and just spend money because it’s fun? $25 drinks for you and all of your friends, surf and turf every night, private boat tours, and hotels with robes and infinity pools…a dream. Unfortunately, we’re all just normal people. Who make travel budget mistakes and wonder where we went wrong. Maybe we should have booked the boat cruise with the common folk.

There is better news though. We can do crazy, lavish things on vacation. We can spend more money than usual. But it has to be planned. The key is an effective, do-able travel budget.

Travel budgets are not a restriction or a set of rules. What they are, is the freedom to spend without guilt. They act as a guide and help give you a realistic plan. But there are common mistakes that end up making you feel like it’s impossible. Here are the travel budget mistakes to avoid:

1. It’s Non-Existent

Do you know the quickest way to an overpriced vacation? Not having a budget. Waltzing through the week like you’re Jay-Z without the slightest insight of how much you’ve actually spent because you deserve it and you’ll figure it out when you get home.

No. No, no, no, no… don’t do it. Numero uno of travel budget mistakes. Trust me, the pain or anxiousness you feel before you start to create a vacation budget is far less than that of returning home to an empty account. Have an idea of how much you have to spend. And estimate where this money you saved is going to go between flights, accommodations, and spending.

Heads up. Next up is a step-by-step guide on How to Create a Travel Budget. But first, I want you to know the potential mistakes.

2. Underestimate Costs

I know, budgets can be tough to predict. And your brain tends to trick you into phrases like oh, it probably only costs this much or, I won’t spend that much, $X is my limit. Unfortunately, you probably will spend that much. We tend to relax more when it comes to money on vacation. We spend freely which may be good for our soul but pretty bad for our budgets.

The best rule of thumb to avoid travel budget mistakes is to overestimate everything. Because let’s be honest. When the bill comes to the table, it’s always a little more than you think. Plus, you have to tip. And you had a couple of strong drinks and everyone is ready for a nightcap at the next spot.

- I overestimate flights by $50.

- I add $10 to just about every meal—usually about $25 total for lunches and $40-50 for dinners.

3. Don’t Account for Small Expenses

We all know expenses can add up quick. Even the little ticky-tack ones. It’s the airport snacks, Uber rides, gas, and souvenirs that break our budget. We tend to overlook these expenses and focus on going out to eat or partying and then return home wondering why we spent $100-200 more than we thought. Avoid the small travel budget mistakes by taking these into account when you start creating it.

4. Money Mindlessly Coming Out of Everywhere

It’s tough to track money on vacation, let alone when you are spending cash, swiping a debit card, and using two different credit cards, all at random. That said, it’s possible to be organized using all three.

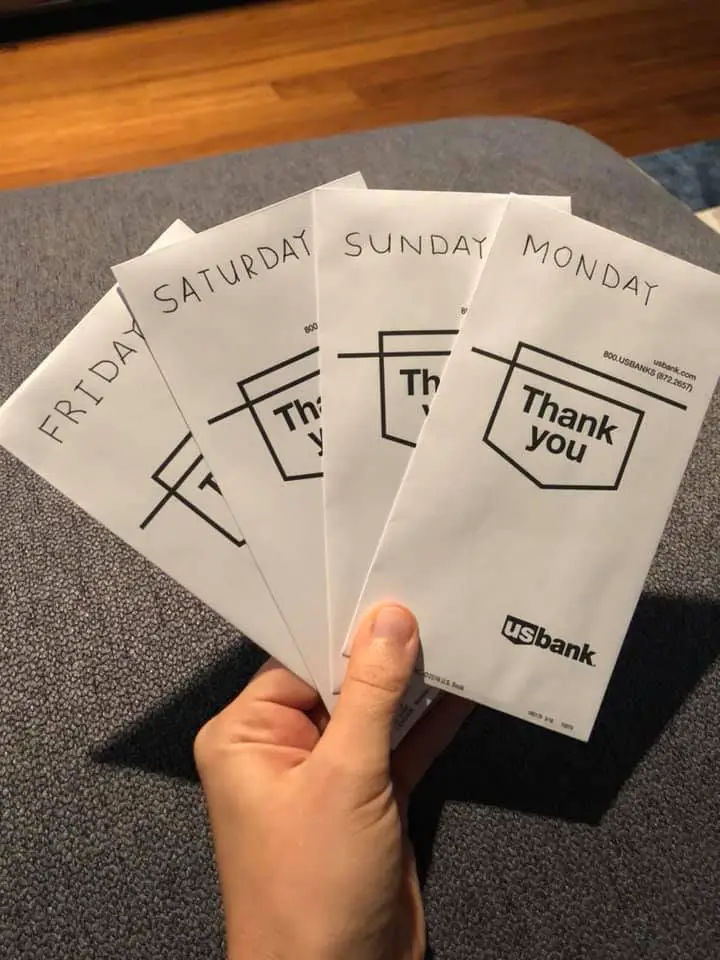

CASH FIRST

I take out $100 cash per day for every day of my trip (including travel days) and put $100 into separate envelopes. Some days cost way less than others (beach day!) so if I don’t use it all, I transfer it to the next day’s envelope which may be more expensive (excursions!). If I go over, I’ll typically use a credit card—though now I fully understand that I’ve already spent $100 and may second guess any mindless spending.

Note: This $100 is an average. Tropical destinations like Maui or Aruba are at least $125 per day. And short road-trips close to home might be around $75.

CREDIT CARD BACK-UP

As I mentioned, I use a credit card when I go over my daily budget. My system above rarely calls for this, but using a credit card gains me points, ensures I’m not going to overdraft, and keeps my future days organized instead of spending the next day’s funds.

DEBIT CARD HANDY

As far as spending money, I save enough for $100 cash per day plus an extra $100 that I leave in my checking account. This is extra money for things like Ubers, drinks on an airplane, or any other instance where cash is not an option.

Extra Tip: sometimes using a credit or debit card is easier (splitting a bill, purchasing an excursion online vs. in-person) so if you run into this, use your card but make sure to pull cash from your envelope and stash it away. You can get it back into your account when you return home.

4. Talked into Purchases

This one will kill you. Not every purchase your friend values is a purchase you value. #1 Rule of Vacation? Do what you want and can afford. If you don’t want to go to an expensive restaurant, don’t. If you don’t want to spend your day’s budget on a snorkeling excursion, don’t! You can’t use your own money to please other people. (This is all assuming you are not married—in that instance, I can’t help you lol.)

Explain to friends that it’s out of your budget. Suggest alternatives for bars and activities. Tell your friends to go on ahead and you will catch up with them later. Making purchases you don’t want to is going to lead to stress and resentment. Set a budget and stick to it, even under pressure from others.

For more on successfully traveling with others, read Tips for Traveling with Friends.

5. Become Careless

I have fallen victim to this. I have an awesome budget plan in place. And then I get somewhere. It’s new and exciting, I have a couple of drinks, I’m out of my element, and suddenly money ain’t a thang. Lord help us. This is not a great strategy. Now, before I go on, let me be clear. If this happens one night—IT’S FINE. Live your life. Eat too much. Drink too much. Buy something you love. As long as you didn’t buy tequila shots for the entire bar, not a travel budget mistake. But do not make it a habit for the entire trip.

$30 over budget each day (really not that much) on a 7-day trip is going to put you $200+ over budget and you might come home to the realization that its ramen or eggs for dinner. And if $200 doesn’t seem like all that much, think of it like this: that’s a plane ticket or 3+ meals on your next trip.

TIPS

- Check your cash on hand + bank accounts. Laying in bed either at night or in the morning without much going on? Log into your online banking app just to check on things. It takes two minutes and you will feel more in control and know all of your expenses.

- Set aside time. Vacation budgets don’t happen in the blink of an eye. But as soon as you hear about a trip, it’s time to start researching to see if you can afford it.

- Practice makes perfect! It took time and a few vacations for me to get all of this in place. Give yourself time to learn.

Travel Budget mistakes are avoidable. Is your budget going to be perfect? No, but it can be close and it can give you the freedom to spend money on what you want and value. So now that you’re convinced, it’s time to create your budget! And if you’re stuck…

What’s Next?

Now that you know what not to do, find out what you should do! Read Travel Budgets: How to Create One that Works and get my budget outline, tips and tricks, and a step-by-step process to follow that includes category breakdowns, how much to save, and more!